However, half of those surveyed across 34 countries describe the quality of their country’s healthcare service as good.

The Ipsos Global Health Service Monitor is an annual study that explores the biggest health challenges facing people around the world today, assessing how well-equipped people think their country’s healthcare services are to tackle them.

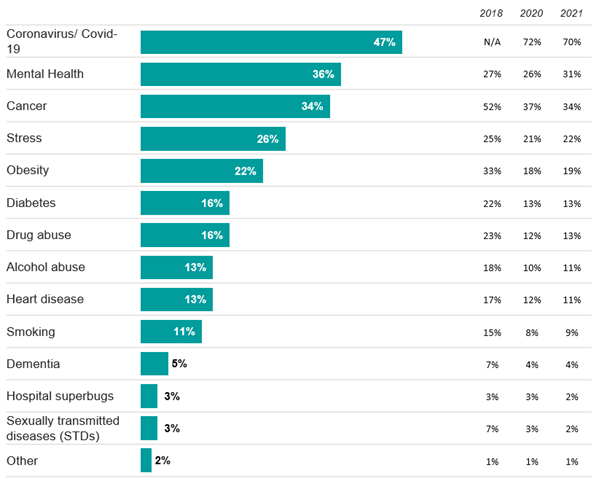

Coronavirus remains the number one concern for a third year running, mentioned by a global country average of 47%, down 23 percentage points on 2021. Japan is the country which shows the highest level of concern about Covid-19 (at 73%), ahead of Peru (66%) in second.

Mental health has, for the first time, taken the number two spot and now succeeds Cancer when people think about health concerns in their country. Mental health is most prevalent as a concern in Sweden (63%), Chile (62%), and Ireland (58%). It has seen a five-percentage point increase year-on-year since 2020 and currently stands at 36%.

Cancer is still a prominent concern, with just over a third (34%) perceiving it as a top worry. The level of concern in Portugal, at 79%, is well above any other country, and by far the biggest concern in the country. Next is Belgium, in second, where 59% single out cancer as a main healthcare concern.

Q: Thinking generally, which of the following, if any, do you see as the biggest health problems facing people in your country today?

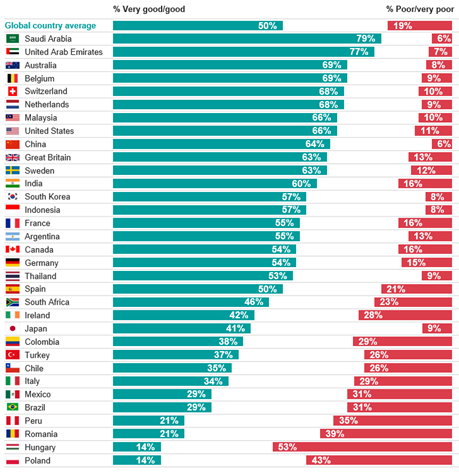

Though the pandemic still lingers, in most of the countries covered in the survey, more than half rate their healthcare system’s quality as “good”. There are some outliers in Latin America and Central Europe, with Brazil (31%), Mexico (31%), and Peru (35%) describing their healthcare as poor. Similarly, Hungary and Poland stand out, with significant proportions thinking their healthcare service is poor (53% and 43% respectively).

Q: How would you rate the quality of healthcare that you and your family have access to in your country?

When asked to look into the future, the outlook is not entirely optimistic. A third (33%) think the quality of healthcare in the coming years will improve and 20% see it getting worse. Contrary to their current pessimism, people in Latin America are more optimistic about their future in relation to the rest of the world. Colombia (71%), Brazil (62%), and Peru (59%) all see quality improving. Meanwhile, nearly half (45%) of Hungarians think it will get worse. France (43%) and Great Britain (39%) are also negative in their forecasts.

There is widespread agreement about the pressures on individual countries’ healthcare capacity. Three in five (61%) globally agree their system is overstretched. Newcomer Portugal ranks first at 87%, followed by Great Britain (83%) whose sense of concern has been consistent over the years.

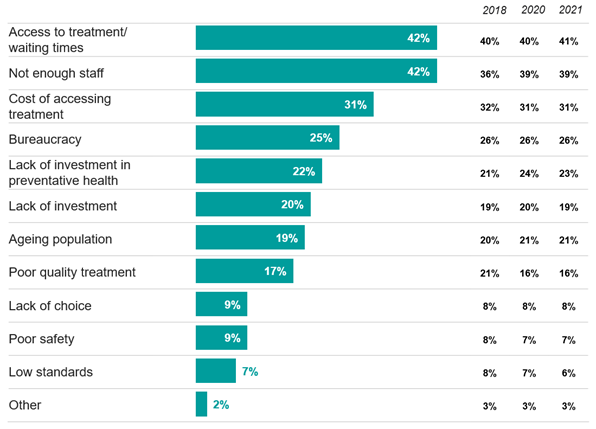

In conjunction with this mood that systems are overstretched, we see that access to treatment/waiting times emerge as the main perceived problems their country’s healthcare system faces – selected by a global country average of four in ten. Not enough staff is joint first for the first time since we started asking these questions in 2018. Cost of accessing treatment is the third most selected issue globally (31%). While no country has bureaucracy as their top healthcare challenge, it is widely recognised among the main issues.

Q: Overall, which of the following, if any, do you see as the biggest problems facing the healthcare system in your country?

Waiting times are a particularly prominent concern in Hungary, Chile, and Portugal (in each country 65% single it out as a challenge). However, this pattern does not follow when we look at where not having enough staff is a particular challenge. Here Sweden (76%), France (69%), and Netherlands (67%) as the top countries.

Although slightly further down the list, bureaucracy is still a challenge for a quarter of respondents (25%). Argentina has it as their joint second highest challenge at 43%, only just behind lack of investment (44%). Other LATAM countries struggling are Mexico (41%) and Peru (39%).

Outside the top issues, we see that lack of investment in preventative health (22%) and lack of investment (20%) in general rank next highest. Ageing population is seen as a challenge in some of the Asian countries: Japan (52%), South Korea (51%), and China (46%).

These are the results of a 34-market survey conducted by Ipsos on its Global Advisor online platform. Ipsos interviewed a total of 23,507 adults aged 18-74 in the United States, Canada, Malaysia, South Africa, and Turkey, 20-74 in Thailand, 21-74 in Indonesia, and 16-74 in 27 other markets between Friday, July 22 and Friday, August 5, 2022.

The sample consists of approximately 1,000 individuals in each of Australia, Brazil, Canada, mainland China, France, Germany, Great Britain, Italy, Japan, Spain, and the U.S., and 500 individuals in each of Argentina, Belgium, Chile, Colombia, Hungary, India, Indonesia, Ireland, Malaysia, Mexico, the Netherlands, Peru, Poland, Portugal, Romania, Saudi Arabia, South Africa, South Korea, Sweden, Switzerland, Thailand, Turkey, and the United Arab Emirates.

The samples in Argentina, Australia, Belgium, Canada, France, Germany, Great Britain, Hungary, Italy, Japan, the Netherlands, Poland, Portugal, Romania, South Korea, Spain, Sweden, Switzerland, and the U.S. can be taken as representative of their general adult population under the age of 75.

The samples in Brazil, Chile, mainland China, Colombia, India, Indonesia, Ireland, Malaysia, Mexico, Peru, Saudi Arabia, South Africa, Thailand, Turkey, and United Arab Emirates are more urban, more educated, and/or more affluent than the general population. The survey results for these countries should be viewed as reflecting the views of the more “connected” segment of their population.

The data is weighted so that each country’s sample composition best reflects the demographic profile of the adult population according to the most recent census data.

The “Global Country Average” reflects the average result for all the countries and markets where the survey was conducted. It has not been adjusted to the population size of each country or market and is not intended to suggest a total result.

Where results do not sum to 100 or the ‘difference’ appears to be +/-1 more/less than the actual, this may be due to rounding, multiple responses, or the exclusion of “don’t know” or not stated responses.

The precision of Ipsos online polls is calculated using a credibility interval with a poll of 1,000 accurate to +/- 3.5percentage points and of 500 accurate to +/- 5.0 percentage points. For more information on Ipsos’ use of credibility intervals, please visit the Ipsos website.

The publication of these findings abides by local rules and regulations.